Setting Up Tax Regions

Setting up Tax Regions is to automatically apply the tax to an order.

The primary tax to be applied is the one set within the customer profile. If it is blank, it will apply the tax from your tax regions based on the postal code of the ship-to address within the order. Please check your provincial/state law whether the tax is destination-based or origin-based.

Tax Regions can be set in two areas in Blast Ramp: under the customer profile and under the Tax Regions setup screen.

Setting up taxes on Customer Account:

The best place to add your tax rates is directly on the customer account, that will ensure all orders created have the correct tax.

Navigation: Customer > Load customer > View.

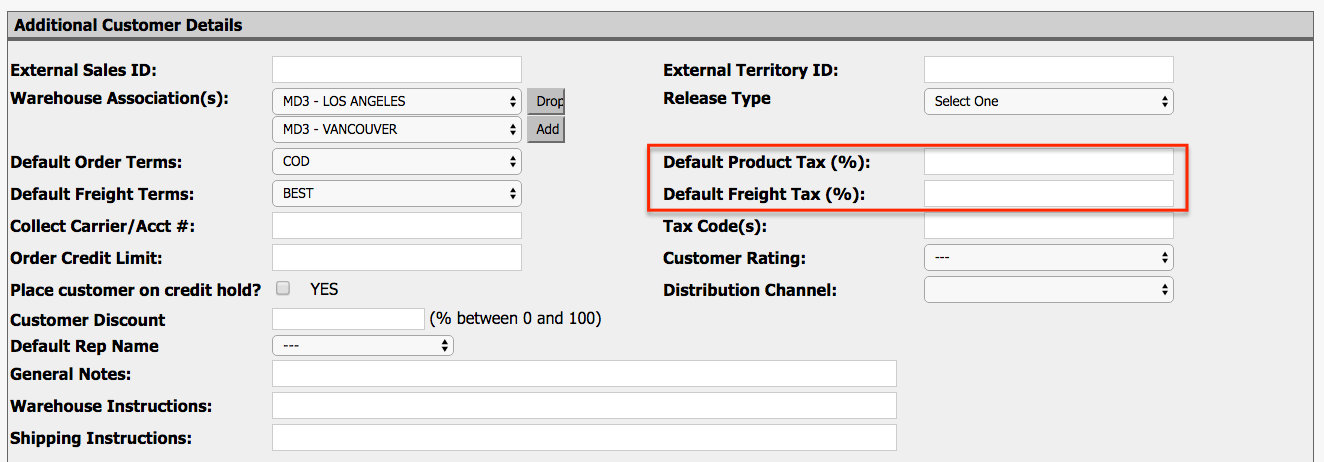

-

Click Edit Account > Add the taxes under Additional Customer Details > click Save.

Tip: If you want to use the Tax Region to select the appropriate tax when creating an order, make sure the customer account taxes are blank when you upload your customers into Blast Ramp.

Note: Historical customers will not get auto tax rates. See the tutorial on Tax Rate Audit Options.

Setting up Tax Regions:

When you have your Tax Regions setup, all customers that are created through order creation will have the appropriate tax rates set as the default tax rate on their customer account.

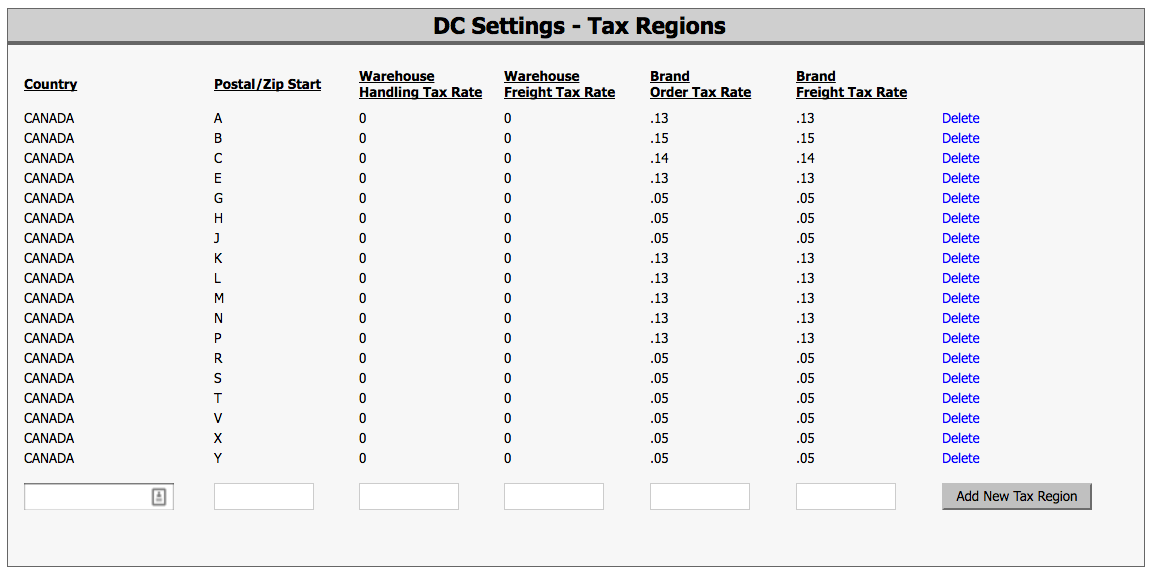

Navigation: Advanced > Administration > DC Settings > Tax Regions

-

Enter the Country > Postal Code Start letter > enter tax rate for both Order and Freight Tax Rate > click Add New Tax Region.

The Warehouse Handling and Freight Tax Rate columns are for 3PL only.

Tip: Must enter the decimal point .05; if you just enter 5, it will tax it as 500%.