The three tax rate audit utilities should be used on a regular basis to ensure that you're charging the correct tax rate to all customers and orders. A fourth utility is used to update shipped orders in the last 3 months.

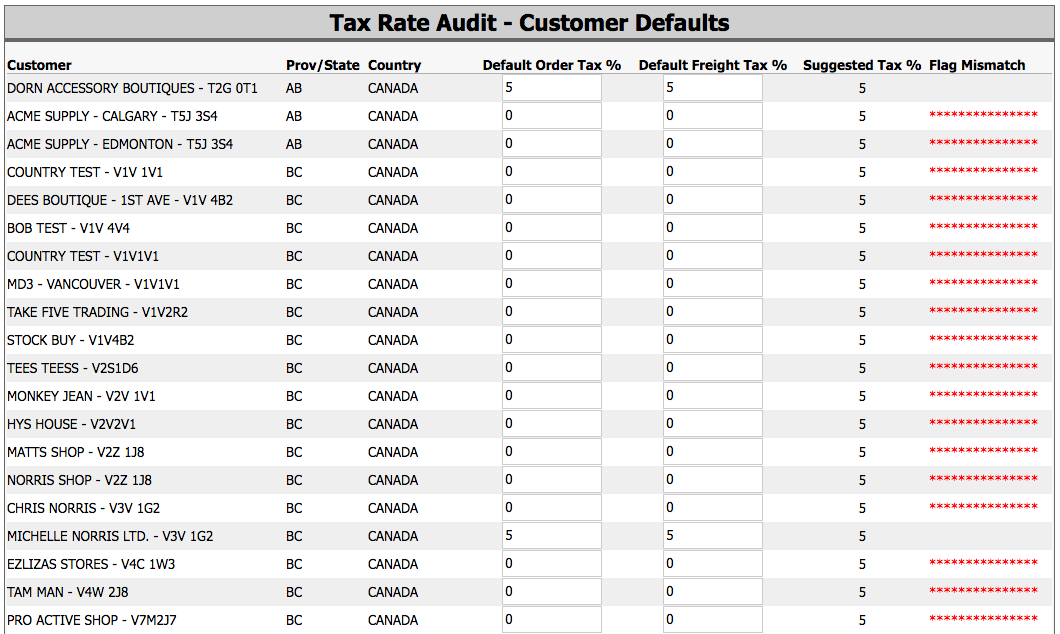

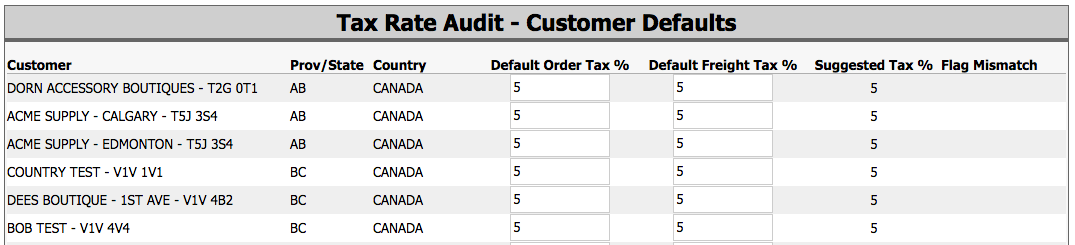

A) Audit Customer Tax Rates:

Navigation: Advanced > Utilities > Tax Rate Audit - Customer Defaults

- This utility is used to review all customer defaults tax rates. You will see what customer accounts have default tax set up or not.

- The Suggested Tax % column is populated by the Tax Regions you have set up.

- Manually enter the value in both columns > click Update Tax Rates.

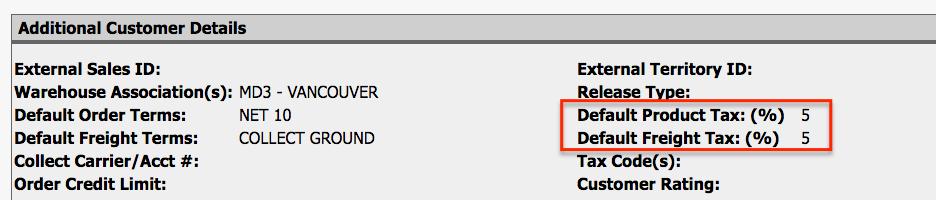

- Once updated it will display under each customer account the default tax rates.

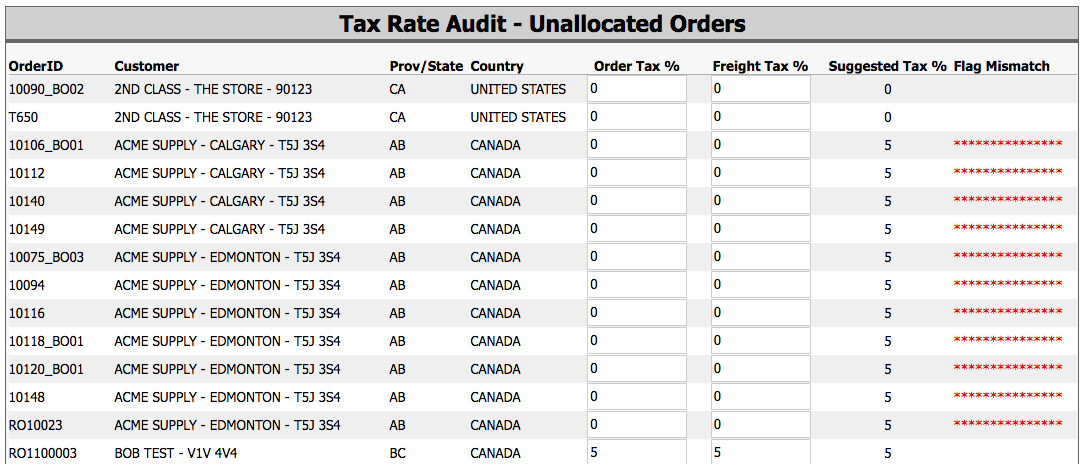

B) Audit Unallocated Orders:

Navigation: Advanced > Utility > Tax Rate Audit - Unallocated Orders

This utility will display all your unallocated orders with the current tax rates. Here you have the option to update the tax rates for each order displayed. Click Update Tax Rate if needed.

The Suggested Tax % column will displays the tax that currently defaulted in the customer account.

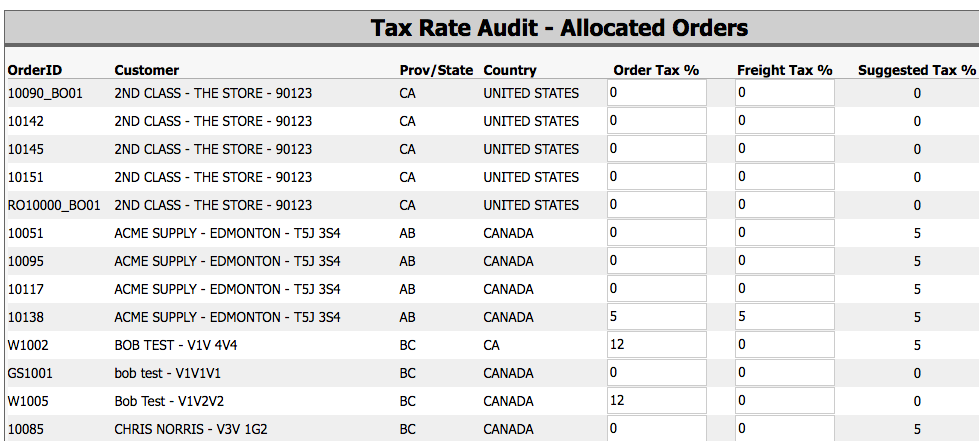

C) Tax Rate Audit - Allocated Orders:

This utility will list all your allocated orders with the current tax rates. Here you have the option to update the tax rates for each order displayed. Click Update Tax Rate if needed.

The Suggested Tax % column will displays the tax that currently defaulted in the customer account.

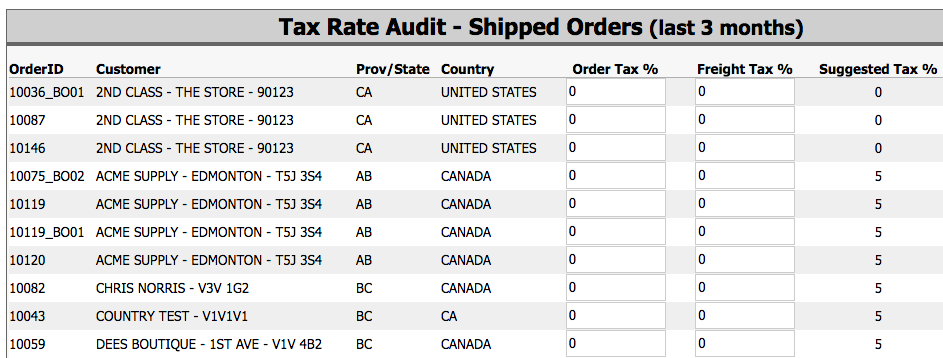

D) Tax Rate Audit - Shipped Orders (last 3 months):

This utility will list all your shipped orders within the last 3 months. Here you have the option to update the tax rates for each order displayed. Click Update Tax Rate if needed.

The Suggested Tax % column will displays the tax that currently defaulted in the customer account.